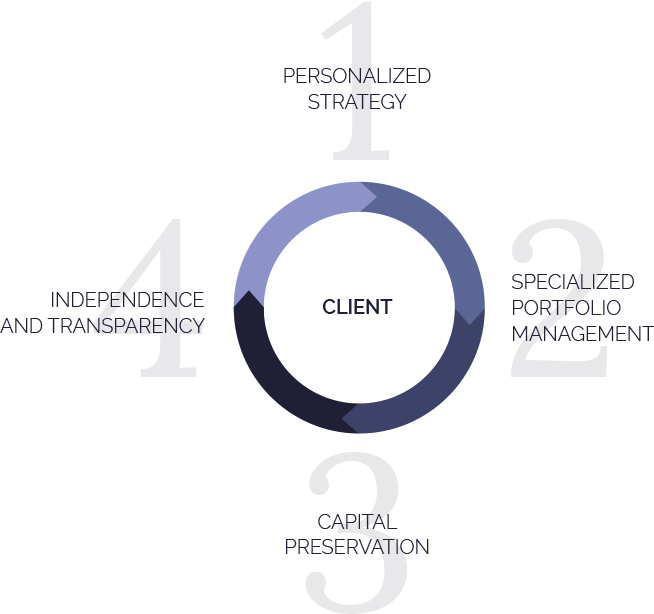

PERSONALIZED STRATEGY

The first step for Valuation Advisors is to get to know the client profoundly, considering different factors such as , the phase of life they are at, analyzing their risk profile, their investment history and experience, their objectives, expectations, and priorities.

This knowledge, combined with a macroeconomic analysis, allows for the development of a personalized investment strategy, with a specific plan for the clients to achieve their goals.

With the objective of finding the adequate line of interest for our clients, and the most efficiency, we evaluate investment opportunities through all types of products.

We do a rigorous analysis of managers and the best products in their respective categories.

La elección y aprobación de nuestros socios comerciales se realiza mediante un riguroso y minucioso proceso de «due diligence», en el que valoramos a los gestores que presentan una identidad clara, sólida reputación y un alto nivel de especialización y transparencia.

SPECIALIZED MANAGEMENT

OF PORTFOLIOS

The next step consists of designing the most efficient portfolio for the desired strategy, according to the stablished mandate. We execute orders of security purchase with agility and autonomy, and thereafter we do the portfolio control and follow up.

Our job includes a permanent actives follow up. When necessary, given changes in scenery or client objectives, we revise the adopted strategies, and realign the portfolio.

The firm uses a personal methodology for risk evaluation, and equilibrium of portfolios. This method of risk calcifications results in a more transparent portfolio management.

CAPITAL PRESERVATION

The search of profitability, is associated with risk. For this reason, our system carries through stress tests regularly, to analyze the behavior of the portfolio in different sceneries, of high volatility, or market disruption, calculating how much the portfolio can oscillate.

Valuation Advisors acts with an efficient structure focused on a personalized attention exclusive for their clients.

INDEPENDENCY

AND TRANSPARENCY

Valuation Advisors offers investment management services. We act without conflict of interests, as we do not have a treasury position.

The selection process and product assignation is realized in a clear way for the client to have total security that the final result will be aligned to the profile and objectives of the client.

The investment can be done through an administered portfolio, investment funds, fixed income, equity, etc.

Easy-to-understand reports consolidate the client's position and facilitate the monitoring of their portfolio.